I’m extremely money conscious. I can’t help it. I blame my accountant dad for it. I’m pretty sure I knew what budgeting was at the age of five. I consider this a life-saving skill, as it’s gotten me out of a job I hated and traveling the world in a matter of 14 months. We have a logistics manager on the ground in South Africa to coordinate food and water delivery to the village, but I was recently asked to assist in budgeting for food and water for the program. Compared to what I’ve been dealing with lately, the task sounds quite refreshing to me. I wrote a while back on my money earning tips, but I’d say I’m much better at saving than earning. Here are some ways I saved money to travel last year:

1. Banking: One of the most common questions discussed when traveling is how to access and save money while abroad. I have bank accounts at four banks: Bank of America, CapitalOne, ING Direct, and a small local bank in Kentucky. The small bank in KY doesn’t charge me for ATM transactions and reimburses me for four ATM transactions per month if another bank charges me. I withdrawal solely from this account when I travel (ahem, except when I lose my ATM card in Ubud). I had my savings at ING for quite a while before moving some of it over to CapitalOne due to interest rates. ING is more accessible, while CapitalOne has the better rate so I continue to use both. I use my Bank of America account when I’m in and out of Columbia.

2. Credit Cards: When I’m in the US, I use an American Express Blue Sky card that charges no annual fee. I also earn $100 back for every $7500 I spend. While I don’t use a credit card very often while I’m abroad, when I do, I use CapitalOne. They charge no foreign exchange fee and have better exchange rates than many cards.

3. Food & Dining: I’m not a coupon clipper. I have friends who are, and it makes me wish sometimes that I were savvy about coupons. Instead, I pay close attention to sales and try to stock up on things when they go on sale so I don’t have to buy them for a while. I’m a dedicated Publix shopper, and I also like a lot of their store brand products. For work I almost always made my lunch, which saved me from going out to eat often. Of course, to balance my stress and anxiety levels at work, I started eating out more at my job so that my sister could meet me and help me make it through the day! Finding a balance is key though. I usually went out to eat every Friday with family and friends and possibly one other night. I think I’d go stir crazy if I was at home doing nothing every night of the week, so for me it was about balance.

4. Entertainment: I love the library. The entire time I saved for my around the world trip, I never bought a single book. I checked them all out at library for free. I’m also very lucky in the fact that my library purchases most new music and movie releases. We stopped going to the theater and started reserving all of the movies we wanted to watch at the library. It’s completely free! My parents live in a much smaller town, and pay $1 to rent a movie from a small collection at the library, but that’s much cheaper than paying for several people to go to the theater. I also looked for free or cheap things to do in a local paper. I’m a fan of going to see local bands, and if it only costs me a $4 drink, I’d say it’s worthwhile.

5. Destinations: If you scroll through my categories on the right side of my site, you’ll see that I haven’t exactly been a first-class traveler. I’m very fortunate in the fact that I’d rather traipse through southeast Asia or overland through Africa than spend a month in Paris. Don’t get me wrong- I’m dying to go to Paris, but on extended travel, I’d rather immerse myself in a culture completely different from my own (and in one that I can afford).

6. Savings: While working full time, I deposited half of my paycheck into savings every month. Then, any commission I earned or money I had left at the end of the month would also be rolled over into savings. If I can’t see it in my checking account, I won’t spend it. Like I said, I like to put every single purchase on my AmEx card to receive cash back, but some people like to carry a certain amount of cash during the week, and when it’s gone it’s gone.

7. Booking Travel: I scour travel sites such as Expedia, Vayama, and Hostelworld, while also looking to book direct with airlines and hostels. I find that if I’m flying Delta, for example, it’s always been cheaper to book directly with the airline. Usually hostels are the same price on their website as Hostelworld, in which case I book with Hostelworld because I have a discount card. In Italy, though, my mother and I stayed in a guesthouse that was running a special of ‘Book two nights and get the third free’ so I booked with it directly rather than on Hostelworld. I wouldn’t rule out travel agents either. Sometimes you can give them the best price you’ve found and see if they can beat it.

8. Splurge When It Counts: Lastly, even though I was pinching pennies to travel so quickly, I still paid for a gym membership and a personal trainer. Running and training for a marathon became my distraction from work, and the money I spent at the gym was worth every penny for my sanity. I accounted for it in my budget every month so it wasn’t an issue.

Have any penny-pinching tips?

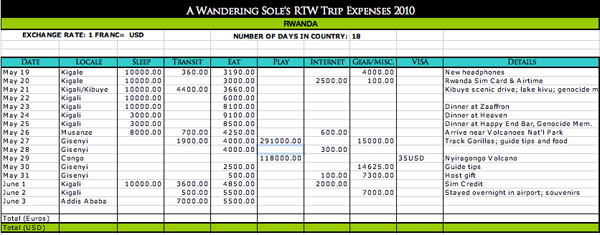

Note: The spreadsheet I made to keep track of my expenses was adapted from Shannon’s over at A Little Adrift.

Great advice to start a budget. I know too many people that fear them and I think they are the single most important aspect to getting your finances in order!

You spiffed it all up! Love looking at budgets and how much people are spending on the road. As for budgets back home…I have to admit I could be doing better there, I try to consciously kick the Starbucks habit and other daily things that aren’t necessary, but I don’t write it down, which I know I should!

I am such a freak about keeping track of all my expense. Glad I’m not the only one :-)

My savings tip is to prep all your snacks/ meals for the week on a Sunday. I brought all of my lunch and snack food to work for the whole week on Monday so that I wasn’t tempted to go out to eat or hit the vending machine.

Something that doesnt charge foreign exchange fee sounds like a winner to me. Great way to start a budget! Its amazing to me how many people just kind of wing it and wonder why there are rapidly spending their money.